Rohene Srikaran

on a wonderful meditation journey

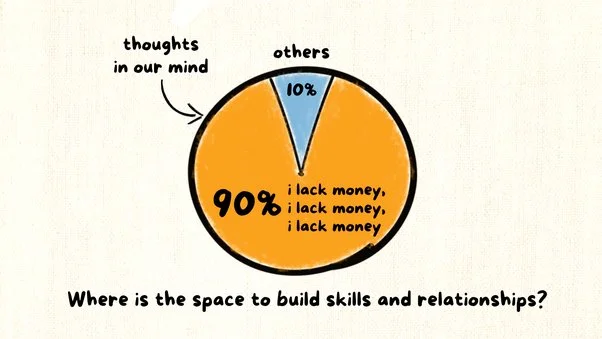

My overthinking reduced when I took the following actions:

1. Build skill set continuously

“Don’t chase money. Build your skills. The money will then come.”

A schoolteacher once said this to me. As a teenager facing financial difficulty at the time, this was eye-opening. I’ve applied this throughout my life and find that this works for me. From getting a university degree to specializing in food regulatory compliance to adapting to increased digitalization, the skillset I’ve built over the years has helped me a lot in my career progression.

2. Learn how to problem solve

There are more complainers than problem solvers. If you can provide solutions that works and meets people’s needs, the money will come. Problem solving is one of the key elements that helps me thrive in my job.

3. Build good relationships with people

We rely on each other’s support, cooperation, strengths and capabilities to make things work. So, listen well to your clients and teammates. Have a sincere, generous, understanding and accepting mind. This will help build solid relationships and garner their support.

4. Understand current financial situation

- Do an assessment: How much do you earn? How much are you spending and where do you spend it? What debts do you have?

- Write it down.

- Set a budget e.g. 50% maximum on living cost, 10% on learning; 20% saving etc.

- Stick to it.

- Review your financial situation periodically

5. Increase financial literacy

- Start with basics. Read up on money management rules that it is relevant to your age and the country that you’re based in. For example:

- there is the 50/30/20 guide i.e. 50% needs, 30% wants, 20% savings

- there’s also the guide that I like from Li Ka-Shing, one of Asia’s richest people, about 5 sets of funds: 30% living expenses, 25% investing, 20% networking, 15% learning, 10% travelling.

- Understand the different financial products available and its associated risks e.g. term deposits, savings with insurance plans, stocks, unit trusts, real estate, cryptocurrency, NFTs etc.

- Talk to a financial planner if it helps. Just by talking to them, you can gain different perspectives that can spark different ideas on what you can do.

For me, I’m grateful to have a friend who’s really good at financial planning. Through her as well as reading online, I’ve learnt useful tips e.g., keep 3x my current salary as emergency funds and where to save/invest 20-25% of my salary etc. Also I’ve used Li Ka-Shing’s advice as a guide and have adjusted it to make it work for me.

6. Keep up with the times

Due to rapidly changing times, I find that I needed to quickly adjust and adapt myself to stay ahead e.g. attaining newer more relevant skills, thinking broadly rather than in silos. And this trend is not just for individuals. I’ve also seen how businesses that adjust and adapt quickly to the current situation turn out to be more resilient in the long run.

7. Meditate

Meditation is a big part of my daily life. I cannot live without it.

By discarding my false minds and self-centered delusions via meditation, my habit of overthinking reduced tremendously. I became more grounded, open and accepting. Meditation also created so much space in my mind – and it is this clear mindset that helped me better all of the above.

On top of that, when Covid hit, some family members lost their job and some had their salary reduced by half. As a result, I had to support them throughout the lockdown period. We had no idea that lockdown would last for so many months. During those uncertain times, I’m just glad that I meditate because it allowed me to do what I could without overthinking about their safety or finances.

The above is what works for me. I hope it can offer some insights that you can adjust to make it work for you. I’m also leaving a video below which I find helpful. All the best!! 🍀💛

If you want to learn how to meditate and stop overthinking, schedule your free 30-minute consultation.